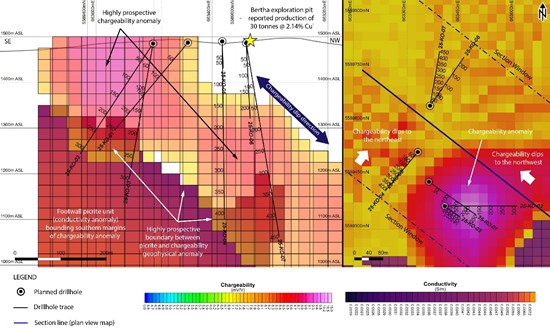

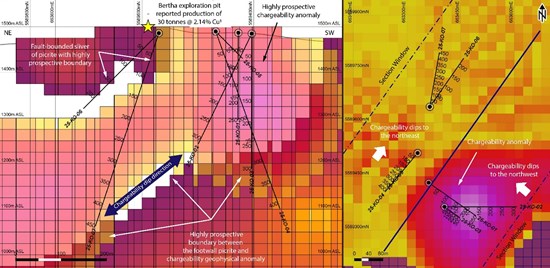

Edmonton, Alberta--(Newsfile Corp. - November 19, 2025) - Torr Metals Inc. (TSXV: TMET) ("Torr" or the "Company") is pleased to report the completion of approximately 2,100 metres (m) of diamond drilling with 7 drill holes at the Bertha Target, within the Company's 332 km² Kolos Copper-Gold Project in south-central British Columbia. Drilling has targeted a prominent moderate-chargeability induced polarization (IP) geophysical anomaly, identified as a supergene oxidation horizon; along with an adjacent highly prospective conductivity-chargeability contact zone (Figure 1, Figure 2), where a picrite unit forms the footwall to the oxidation horizon. Assay results are pending, with holes 25-KO-01 through 25-KO-06 currently submitted to the laboratory.

Importantly, this chargeability-conductivity contact is exposed at surface within the historical Bertha exploration pit (Figure 1, Figure 2), which reported 30 tonnes at 2.14% copper (Cu) from limited past production1 consisting of native copper (Cu) and chalcocite mineralization. Torr recently confirmed the copper-rich potential of this contact zone through a rock grab sample assaying 16.9% Cu (see August 13, 2025 news release).

In addition to the broad chargeability anomaly, the Company interprets this contact as a major redox and structural interface that served as a focal point for hydrothermal supergene copper mineralization, a geological setting analogous to the upper levels of the New Afton Copper-Gold Mine2, located approximately 28 kilometres to the north-northeast.

Drill Targets Highlights:

Chargeability Anomaly Indicates Scale Potential and Strong Structural Controls: The overall geometry of the chargeability anomaly appears controlled by the contact with the footwall picrite unit, identified by its strong conductivity (Figure 1, Figure 2). The orientation of this contact shifts from a northwest dip in the southeastern portion of the anomaly (tested by holes 25-KO-01 to 03) to a north to northeast dip within the western portion (tested by holes 25-KO-04 to 07).

Highly Prospective Redox and Structural Trap: The contact between a reducing picrite and an oxidized intrusive-volcanic complex defines a prime redox boundary where copper-bearing fluids are reduced to produce native copper and chalcocite, a key process observed within supergene environments such as at the Bertha exploration pit and New Afton2.

Drill Testing Confirms Depth and Orientation of Targeted System: Torr has drilled across the moderate dips of the chargeability anomaly and picrite boundary in both the northern and southern areas to depths >400 vertical metres (Figure 1, Figure 2). Hole 25-KO-07 is advancing to greater depth to evaluate potential down-dip extensions of the main system. Additionally, a >300-metre step-out to the west at the Bertha South occurrence is planned to test the along-strike and down-plunge extensions of the chargeability anomaly.

Malcolm Dorsey, President and CEO, commented: "With approximately 2,100 metres drilled at Bertha and plans to extend the program to 2,800 metres, we are steadily defining a system that exhibits strong comparisons to the redox and structural framework that is described at the nearby New Afton Copper-Gold mine2. Having now completed drilling across the initial width of the target area, our focus shifts to a major step-out to the west to evaluate the down-plunge and dip extent of the system beyond 500 metres. The presence of high-grade copper at surface in the Bertha exploration pit highlights the importance of testing both the picrite contact and the adjoining large, structurally controlled chargeability system to depth, further emphasizing Bertha's potential as a significant hydrothermal-supergene copper-gold target."

Figure 1. 2025 inverted IP geophysical survey showing chargeability (mV/V) and conductivity (S/m) in cross-sectional (SE-NW) and plan view. Note drill sites have been constrained to existing road networks to minimize ground disturbance.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6794/275091_00e48828e4a4da22_001full.jpg

Figure 2. 2025 inverted IP geophysical survey showing chargeability (mV/V) and conductivity (S/m) in cross-sectional (SW-NE) and plan view. Note drill sites have been constrained to existing road networks to minimize ground disturbance.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6794/275091_00e48828e4a4da22_002full.jpg

Geological Interpretation

Oxidation of primary sulphides at the Bertha exploration pit is interpreted to have produced Cu²⁺-bearing fluids that migrated downward and laterally until encountering Fe²⁺-rich picrite lenses and the cohesive picrite footwall. At these redox boundaries, copper was reduced and reprecipitated as native copper (Cu⁰) and chalcocite (Cu₂S), concentrating along the picrite contacts.

The conductive picrite likely acted as both a chemical trap and a relatively impermeable structural barrier, focusing mineralization along its contact with adjacent intrusive rocks and Nicola Group volcanics. In addition, hydrothermal-magmatic veining and brecciation associated with a sulphide-bearing intrusive pulse may have further concentrated mineralization within, and along the base of, the oxidized lithological contact between the picrite and Nicola volcanic units, enhancing permeability, fluid flow, and copper deposition within the system.

October 31, 2025 Private Placement Finders Fees

Further to its news release dated October 31, 2025, the Company wishes to clarify that it paid a total of $214,783 in cash to arm's length finders (each, a "Finder") and issued an aggregate of 1,138,297 non-transferable share purchase warrants to eligible Finders, on the same terms as the Unit Warrants.

1McKenzie, W.A., 1929. Annual Report of the Minister of Mines: Mining Operations for Gold, Coal, Etc. in the Province of British Columbia. Victoria, British Columbia. P. 247.

2Note that the information and comparisons disclosed herein to New Afton are not necessarily indicative of mineralization or assay results at the Bertha Zone or elsewhere across the Kolos Project area.

Quality Assurance and Control

Results from samples were analyzed at ALS Global Laboratories (Geochemistry Division) in Kamloops, Canada (an ISO/IEC 17025:2017 and ISO 9001:2015 accredited facility). A secure chain of custody is maintained in transporting and storing of all samples. At ALS the samples were digested using Aqua Regia and analyzed via ICP-MS and ICP-AES using a 25g sample aliquot under the ALS code AuME-TL43. The Company follows industry standard procedures for the work carried out on the Kolos Project. Due to the reconnaissance nature of the soil sampling the Company relied on the internal quality assurance quality control ("QA/QC") measures of ALS. Torr Metals detected no significant QA/QC issues during review of the data.

Qualified Person

The technical content of this news release has been reviewed and approved by Michael Dufresne, M.Sc., P.Geol., P.Geo., a consultant to the Company who is a non independent qualified person defined under National Instrument 43-101.

About Torr Metals

Torr Metals, headquartered in Edmonton, AB, is focused on unlocking new copper and gold discovery potential within proven, highly accessible mining districts across Canada, areas with both established infrastructure and a growing need for near-term feed. Torr's 100%-owned, district-scale assets are strategically located for cost-effective, year-round exploration and development. The 275 km² Kolos Copper-Gold Project and strategically option 57 km2 Bertha Property, situated in southern British Columbia's prolific Quesnel Terrane, lies just 30 km southeast of the Highland Valley Copper Mine, Canada's largest open-pit copper operation, and 40 km south of the city of Kamloops directly along Highway 5. In northern Ontario, the 261 km² Filion Gold Project covers a virtually unexplored greenstone belt with high-grade orogenic gold potential. It sits just off the Trans-Canada Highway 11, approximately 42 km from Kapuskasing and 202 km by road from the Timmins mining camp, home to world-class operations like Hollinger, McIntyre, and Dome. To learn more, visit Torr Metals online or view company documents via SEDAR+ at www.sedarplus.ca.

On behalf of the Board of Directors

Torr Metals Inc.

"Malcolm Dorsey"

Malcolm Dorsey

President, CEO and Director

For further information:

Malcolm Dorsey

Telephone: 236-982-4300

Email: malcolmd@torrmetals.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

Cautionary Statement Regarding Forward-Looking Information

This press release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking information includes, without limitation, statements regarding the use of proceeds from the Company's recently completed financings, and the future plans or prospects of the Company. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". Forward-looking statements are necessarily based upon a number of assumptions that, while considered reasonable by management, are inherently subject to business, market and economic risks, uncertainties and contingencies that may cause actual results, performance or achievements to be materially different from those expressed or implied by forward-looking statements. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. Other factors which could materially affect such forward-looking information are described in the risk factors in the Company's most recent annual management's discussion and analysis which is available on the Company's profile on SEDAR+ at www.sedarplus.ca. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/275091