(TheNewswire)

|

|||||||||

|

|

||||||||

November 7, 2025 - TheNewswire - TORONTO, ON – Star Royalties Ltd. (“ Star Royalties ”, or the “ Company ”) (TSXV: STRR, OTCQX: STRFF) is pleased to highlight an update by Minera Alamos Inc. (“ Minera Alamos ”) (TSXV: MAI, OTCQX: MAIFF) on the development progress and exploration potential of its Copperstone Gold Mine (“ Copperstone ”). Minera Alamos is currently preparing an updated technical study to support Copperstone’s restart, following anticipated approvals of final amendments to its Mine Plan of Operations (“ MPO ”) which are expected before year-end 2025. All amounts are in U.S. dollars, unless otherwise indicated. Neither TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Highlights

-

Robust Copperstone economics: Copperstone is expected to generate over $297 million in after-tax net cash flow, have an after-tax NPV5% of $227 million, and generate an after-tax IRR of 171% as per the latest Preliminary Economic Assessment ( PEA ”) 1 and assuming a gold price of $3,000/oz.

-

Permitting milestones on track: Minera Alamos expects to receive approval of final MPO by year-end 2025, including amendments to the Aquifer Protection Permit, Air Quality Control Permit, and reclamation plan, positioning Copperstone for a 2026 restart.

-

Fast-track restart strategy: Engineering activities have been ramped up to optimize plans for the mine restart and process plant installation. Under the authorization of the existing permits, site development activities can be initiated in parallel with the pending MPO amendment to “fast-track” the project restart. Transfer and refurbishment of already-owned 1,000 tpd process plant equipment (PEA mine plan was modelled at 600 tpd) to site is expected to be largely complete by year-end 2025, to be immediately followed by installation and refurbishment.

-

Upcoming technical report: In parallel, an updated technical study is in progress, with engineering efforts focused on optimizing mine design, plant flexibility, and capital efficiency. Opportunities to mine and process at higher rates to support future resource expansion potential are being assessed. The updated technical report is expected in the first half of 2026.

-

High-grade underground gold resource and exploration potential: Copperstone hosts 300,000 oz of Measured and Indicated resources (1.2 Mt at 7.7 g/t) and 197,000 oz of Inferred resources (0.97 Mt at 6.3 g/t), based on a gold price of $1,800/oz. Minera Alamos’ review of its exploration results suggests the deposit is part of an iron oxide-copper-gold (“ IOCG ”) system, with potential for deeper mineralization and shallow open-pit extensions near the historic pit. A Phase 1 drill program is being finalized for early 2026 to assess near-surface material beside the historic open pit and at depth along strike to further delineate underground resources.

-

Enhanced stream valuation: The Company estimates its 4% gold stream on Copperstone to generate approximately $5.3 million in pre-tax cash flow during the mine’s first year of production and $24 million in life-of-mine pre-tax cash flow, prior to any mine-life extension from resource conversion and exploration success, as per the latest PEA and assuming a gold price of $3,500/oz.

-

Equity ownership of Minera Alamos: The Company owns approximately 7.8 million shares of Minera Alamos, valued at C$2.9 million as per Minera Alamos’ latest closing share price. In addition to Copperstone’s upcoming development and construction milestones, Star Royalties anticipates several additional catalysts in 2026 that could positively re-rate its Minera Alamos equity ownership, including consistent production and operating cash flows from its Pan gold mine in Nevada and permitting developments at its Mexican assets.

Alex Pernin, Chief Executive Officer of Star Royalties, commented: “We are encouraged by the latest Copperstone development progress from Minera Alamos. The project’s economics and our stream’s valuation at today’s robust gold prices continue to demonstrate significant cash flow generation potential for Star Royalties that is not reflected in our share price. In addition, the new interpretation of Copperstone’s host geology provides a highly constructive pathway to meaningfully extending the life-of-mine well beyond what is currently contemplated in the PEA. Given that Copperstone’s current mine plan only incorporates half of its current high-grade resource, we look forward to the Phase 1 exploration program in the next few months and its potential impact on Copperstone’s mineral inventory. We also highlight complementary efforts by Minera Alamos to access opportunities for plant flexibility to support expanded processing rates and overall higher annual gold production.”

Copperstone Exploration Potential

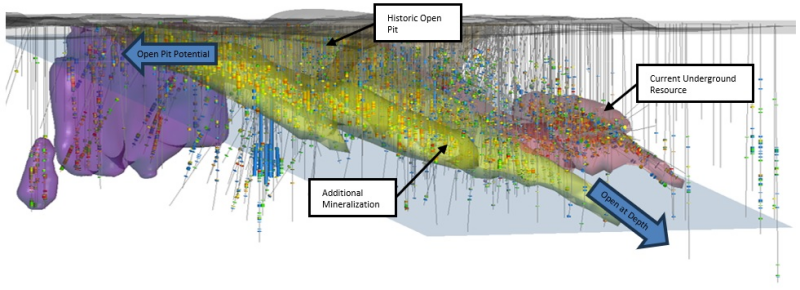

Following a detailed review of available Copperstone drill core and field investigations of exposed gold mineralization in the open pit and underground workings, Minera Alamos confirmed that the gold and subsidiary copper mineralization is hosted by a shallowly northeast-dipping fault zone, suspected to be a thrust rather than a traditionally assumed extensional listric normal fault. The gold mineralization occurs with stockworks of specular hematite partly transformed to magnetite, which is typically associated with IOCG deposits . An IOCG affiliation implies that gold mineralization could occur over a large vertical extent rather than being confined to a shallow, near-surface interval, as would be historically interpreted. In addition, the current underground mining resource area appears to be open both along strike and at depth (see Figure 1 below), while potential for shallow open-pit gold mineralization occurs close to the current pit limits, especially to the southeast.

Figure 1: Copperstone drillhole identified mineralization (looking NNW). Source: www.mineraalamos.com

Minera Alamos indicated that the Phase 1 drill program is currently being finalized for Copperstone and is expected to begin in Q1 2026 focusing on shallow mineralization adjacent to the current historic open pit and areas along strike and at depth of the currently outlined underground resources. While this work program is underway, Minera Alamos’ exploration team will also be evaluating the potential for new mineralized structures outside of the current area which had previously been identified by historic exploration drill programs.

The Company is relying on Minera Alamos’ disclosure from its November 6, 2025 press release for the accuracy of Copperstone-related information and on Mr. Darren Koningen, P. Eng., Minera Alamos’ CEO, as the Qualified Person responsible for the technical content related to Copperstone under National Instrument 43-101.

CONTACT INFORMATION

For more information, please visit our website at starroyalties.com or contact:

|

Alex Pernin, P.Geo. |

Dmitry Kushnir, CFA |

|

Chief Executive Officer and Director |

VP, Investor Relations and Strategy |

|

+1 647 494 5001 |

About Star Royalties Ltd.

Star Royalties Ltd. is a precious metals and carbon credit royalty and streaming company. The Company’s objective is to provide wealth creation by originating accretive transactions with superior alignment to both counterparties and shareholders. The Company offers investors exposure to precious metals as well as carbon credit prices through its pure-green joint venture, Green Star Royalties Ltd., having innovated the world’s first carbon credit royalties.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

Certain statements in this news release may constitute "forward-looking statements", including those regarding future market conditions for metals and minerals, future valuation of Minera Alamos, development and production of Copperstone, permitting and construction scheduling of Coppertone, future location of Copperstone grinding and flotation equipment, expected future cash flow from the stream agreement, the Company’s position in Copperstone’s future gold production, the net cash position of the Company, and future capital raising opportunities are statements that address or discuss activities, events or developments that the Company expects or anticipates may occur in the future. When used in this news release, words such as "estimates", "expects", "plans", "anticipates", "will", "believes", "intends" "should", "could", "may" and other similar terminology are intended to identify such forward-looking statements. Forward-looking statements are made based upon certain assumptions and other important factors that, if untrue, could cause the actual results, performances or achievements of Star Royalties to be materially different from future results, performances or achievements expressed or implied by such statements. Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be an accurate indication of whether or not such results will be achieved.

A number of factors could cause actual results, performances or achievements to differ materially from such forward-looking statements, including, without limitation, changes in business plans and strategies, market and capital finance conditions, ongoing market disruptions caused by the Ukraine and Russian conflict, metal and mineral commodity price volatility, discrepancies between actual and estimated production and test results, mineral reserves and resources and metallurgical recoveries, mining operation and development risks relating to the parties which produce the metals and minerals Star Royalties will purchase or from which it will receive royalty payments, risks inherent to royalty companies, title and permitting matters, activities by governmental authorities, currency fluctuations, the global, federal and provincial social and economic climate in particular with respect to addressing and reducing global warming, natural disasters and global pandemics, dilution, risk inherent to any capital financing transactions. These risks, as well as others, could cause actual results and events to vary significantly. Accordingly, readers should exercise caution in relying upon forward-looking statements and the Company undertakes no obligation to publicly revise them to reflect subsequent events or circumstances, except as required by law.

1 "National Instrument 43-101 Technical Report: Preliminary Economic Assessment for the Copperstone Project, La Paz County, Arizona, USA" with an effective date of February 6, 2025.

Copyright (c) 2025 TheNewswire - All rights reserved.