(TheNewswire)

|

|||||||||

|

|

|

|

||||||

October 1, 2025 – Rockport, Ontario– TheNewswire - New Age Metals Inc. (TSX.V: NAM | OTCQB: NMTLF | FSE: P7J) (“NAM” or the “Company”) is pleased to announce that, effective September 30, 2025, it has entered into an option agreement, after completing its due diligence, with arms-length parties, Mr. Doug Bundy, Mr. Dave Burt and Mr. Jon Burt, who are all local Kenora Mining District Prospectors. The Project consists of 114 mining claims and 1 patented Mining Claim totalling 2,191 hectares or 5,414 acres. The Project is located ~25 km southeast of Kenora in northwestern Ontario. The Company has the option to acquire a 100% of the Project subject to a 2% royalty, which the Company has a option to buy down the royalty to 1% for $1 million.

Highlights

Highlights of the Bonanza Gold Project are:

-

Multiple high-grade mineral occurrences with spectacular visible gold at surface;

-

Excellent infrastructure, including road access to all areas to the Project and provincial grid power lines;

-

Location 25 km southeast of City of Kenora, a major northwestern Ontario economic hub with a population of ~14,800;

-

Select due diligence surface grab sample assays include 1.1 g/t Au, 3.7 g/t Au, 8.9 g/t Au, 13.2 g/t Au, 22.2 g/t Au, 31.9 g/t Au and up to 127 g/t Au from five prospects on the Project (see Table 2 below);

-

Lack of modern-day exploration; and

-

Drill-ready with 3-year permits in place.

With the gold price and demand at historic highs, parts of the Kenora District have seen limited application of modern exploration methods, which provides NAM with an opportunity to unlock significant value through the use of new techniques, advanced technologies and upgraded mineralization models. Our long-term goal is to assemble a district-scale gold asset in Kenora that can ultimately attract the attention of major gold producers that are now cash rich with significant new exploration funds, as a result of their recent enhanced profitability. Given the severe lack of funds in recent years for the junior mining industry, there has been little new modern-day exploration completed in this region.

Chairman and CEO Harry Barr states , “We began our search for new gold assets in early 2024, leading to the establishment of our Gold-Antimony Division in Newfoundland in early 2025. Since then, our technical and management teams have been systematically reviewing projects on an international scale. Always more comfortable with North American assets, we believe the Bonanza Gold Project and parts of the Kenora Mining District have been under-explored, under-appreciated, and underfunded in recent years. This new acquisition adds to our diversified mineral portfolio, and we believe it is a significant gold exploration project for the Company . This additional gold Project will allow our shareholders more exposure to what we believe is one of most significant gold rallies in recent history . Gold is not a new metal for the New Age Metals management team and board of directors; in fact, we collectively have over 150 years experience in the gold industry.

From the onset, our corporate objective has been to acquire and develop critical metal projects. Today we are a well financed, multi-asset company that is aggressively expanding its project portfolio across gold, antimony, lithium, and platinum group metals. In my opinion, our flagship asset is still the River Valley Platinum Group Metal Project, in Sudbury, Ontario and both platinum and palladium have enjoyed major price increases in the last 3 months.

In June of this year, NAM upsized its equity position in MetalQuest Mining to ~12%. MetalQuest Mining inc. (TSXV:MQM | OTCQB: MQMIF | FRA:E7Q) who controls a 100% of a substantial, high-purity iron deposit project in the Labrador Trough, Quebec. Approximately $120 million has been spent to date, including a historical NI 43-101 Mineral Resource Estimate and a 2015 Feasibility Study.”

Farid Mammadov, VP Investor Relations states , “ In today’s climate of global uncertainty, gold has once again proven itself to be one of the world’s most essential metals. Prices are at record highs, now trading near US$3,830 (C$5,330) and global demand continues to climb. These market conditions have opened the door for NAM to add to its already diversified and significant project portfolio and mineral inventory. The response to our recent private placement indicates that there is renewed investor interest in both our company and the broader junior mining industry. Proof that the industry is turning around was the recent upsizing of our private placement to $4,000,000. Mr. Eric Sprott indicated his intention to subscribe for $2,000,000 hard dollars for last week’s placement. ”

The Kenora Gold District

The Kenora Gold District, located in northwestern Ontario, has been recognized since the late-1800s as one of Canada’s most prolific gold camps. Known for its high-grade Archean lode-gold deposits, the district has supported mineral exploration and some mining for more than a century. With established infrastructure, year-round access, and a highly skilled workforce, Kenora has potential to become a cornerstone of Ontario’s mining industry. Some of the active majors and mid-tier companies in the District are Agnico Eagle, Kinross, Centerra and New Gold.

Terms of the Option Agreement

To exercise the Option, NAM’s agreement calls for a series of cash payments and share issuances to the Prospectors, exploration expenditures on the Project. The share payments will be based on a 10-day trading average before issuance. NAM has the ability to terminate the agreement any time after the first year’s commitments have been completed.

The agreement also provides for contingent milestone payments of $250,000 on the completion of an NI 43-101 compliant Mineral Resource and Technical Report outlining more than one million ounces of gold, and an additional $250,000 for a compliant Mineral Resource exceeding 2.5 million ounces. The Partners will also retain a 2% Net Smelter Return (NSR) royalty, of which NAM has the right to re-purchase 1% for $1 million.

|

Date / Milestone |

Cash Payment |

NAM Common Shares |

Work Expenditures |

|

Within 10 days of Regulatory Approval (Effective Date) |

$40,000 |

$125,000 worth of NAM shares |

N/A |

|

Year 1 (from regulatory approval) |

$60,000 |

$125,000 worth of NAM shares (escrow 6 months) |

$200,000 |

|

Year 2 (from regulatory approval) |

$75,000 |

$125,000 worth of NAM shares (escrow 6 months) |

$250,000 |

|

Year 3 (from regulatory approval) |

$125,000 |

$125,000 worth of NAM shares |

$250,000 |

The transaction and any securities issued in connection with the agreement are subject to TSX Venture Exchange approval and a four-month plus one day hold period in accordance with applicable Securities Laws.

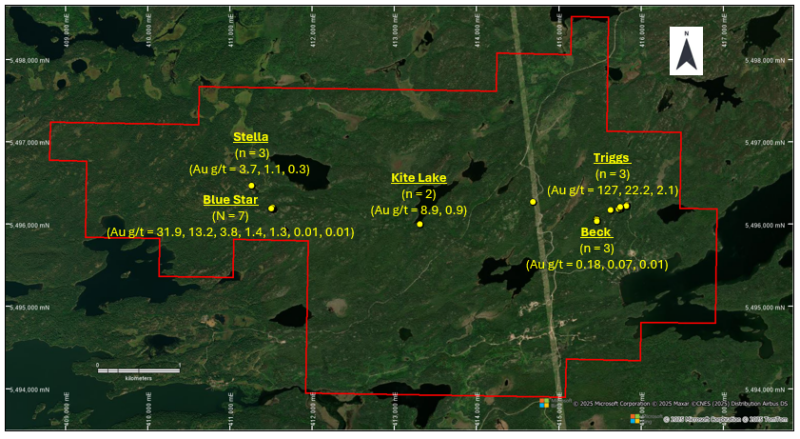

Due Diligence Site Visit and Sampling

A due diligence site visit and verification sampling program was successfully executed in early September, 2025. Twenty-five grab samples were taken from quartz veins, quartz-carbonate veins and sulphide zones at 5 prospects distributed along 4 km across the Property. The mineralized vein and zones are hosted in silicified, carbonated and sulphidized (mainly pyrite) mafic to intermediate volcanic and plutonic host rocks. The rocks are cut by a regional high-strain zone and property-scale and smaller scale structures and generally metamorphosed under greenschist conditions.

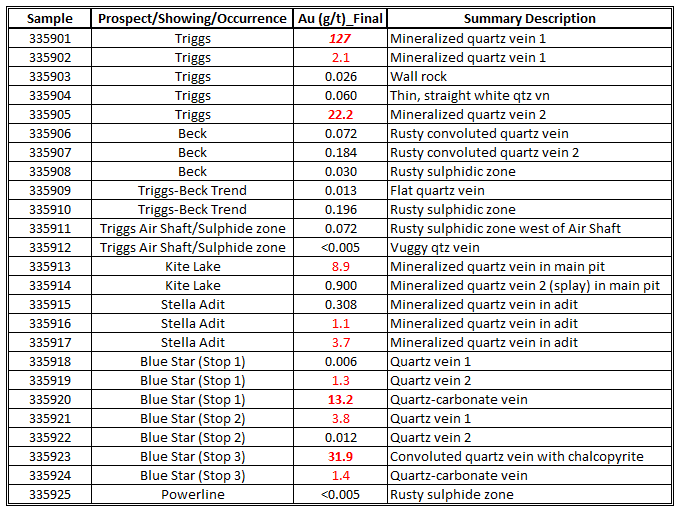

The mineral occurrences sampled and RUSH gold assay results are shown in Figure 1 and listed in Table 1. Photographs of selected high-grade samples are shown in Figure 2. The due diligence program successfully confirmed the presence of high-grade gold mineralization on the Project, particularly at the Triggs, Kite Lake, Stella and Blue Star Prospects.

Figure 1. Assay Results for Due Diligence Verification Grab Samples

Click Image To View Full Size

Note:

The

red outline =

the Bonanza Gold Project

Table 2. Due Diligence Sample Assays

Figure 2. Photographs of Selected Due Diligence High-Grade Samples Collected by NAM Technical Representatives

Analytical Methods, Chain of Custody, and Quality Assurance/Quality Control

NAM maintained a rigorous QA/QC protocol for all the verification rock samples collected for due diligence purposes. Two certified reference materials (“CRMs”) were inserted into the sample batch. The CRMs were sourced from industry-certified providers and selected to match, as closely as possible, the expected mineralization style and grade ranges of the samples.

All samples were individually sealed in heavy-duty plastic bags, labelled with unique sample numbers, and placed into rice bags for transport. Continuous possession of the samples was maintained until they were dropped off at a courier service in Saskatoon for express delivery to SGS Canada Minerals laboratory facilities in Burnaby, British Columbia. At this facility, the samples were weighed and prepared into pulps in accordance with SGS’s standard procedures before being analysed on a RUSH basis for gold.

The analytical work included:

-

Gold: Au exploration grade 50-g Fire Assay with Atomic Absorption Spectrometry (“AAS”) (reporting limits 5 to 10,000 ppb) ( GE_FAA50V5

-

Gold: Au over limit analysis “ore” grade 50-g Fire Assay with Gravimetric Finish (reporting limits 0.5 to 10000 ppm) (GO_FAG50V)

Internal laboratory QA/QC procedures at SGS included the insertion and analysis of certified reference materials, analytical blanks and sample duplicates with the submitted samples to monitor analytical accuracy and precision.

Qualified Person

Dr. William Stone, P.Geo. and a Qualified Person for the purposes of National Instrument 43-101 Standards of Disclosure for Mineral Projects and a consultant to NAM, has collected, reviewed and approved the scientific and technical disclosure in this press release.

The Qualified Person has not completed sufficient work to verify the historical information on the neighbouring and other properties in the Kenora region. Nevertheless, the Qualified Person considers that drilling and analytical results were completed to industry standard practices. The reader is cautioned that mineral occurrences, prospects and deposits on neighbouring properties are not necessarily indicative of mineralization on the Company’s properties. This information may provide an indication of the exploration potential of the Properties, but might not be representative of exploration results.

About NAM

New Age Metals is a junior mineral exploration and development company focused on the discovery, exploration, and development of critical green metal projects in North America. The Company has three divisions: a Platinum Group Element division, a Lithium/Rare Element division, an Antimony-Gold Division as well as an investment in MetalQuest Mining’s (TSXV:MQM | OTC:MQMIF) high purity Lac Otelnuk Iron Project.

The PGE Division includes the 100% owned, multi-million-ounce, district-scale River Valley Project, one of North America’s largest undeveloped Platinum Group Element Projects, situated 100 km by road east of Sudbury, Ontario. In addition to River Valley, NAM owns 100% of the Genesis PGE-Cu-Ni Project in Alaska.

The Company’s Lithium Division is one of the largest mineral claim holders in the Winnipeg River Pegmatite Field, where the Company is exploring hard rock lithium and various rare elements such as tantalum, rubidium, and cesium. NAM is developing its lithium division in conjunction with its Farm-in/Joint Venture agreement with Mineral Resources Ltd. (“MinRes”), one of the world’s largest lithium producers. A minimum budget to maintain the Projects has been approved by Mineral Resources Ltd for May 2025 to April 2026. The Companies agreed to the minimum budget due to current lithium pricing and forest fire dangers in the immediate area

In April 2024, a $1.5M NSERC Alliance grant was awarded to a collaboration led by the University of Manitoba (Drs. Fayek and Camacho), with academic partners from Lakehead University (Dr. Hollings) and industry partners including New Age Metals and Grid Metals. This research is focused on advancing Canada’s critical metals sector, with New Age Metals’ portion targeting its Bird River lithium properties. Approximately $107,000 of work is planned on New Age’s properties in 2025. The early work will include core sampling and field visits starting this summer. The project will likely extend beyond the original 3-year term, due to its delayed start.

New Age Metals Inc. is supporting a successful $180K Mitacs research grant, awarded in 2023, through its $90K contribution (already accounted for and paid under the Mineral Resources joint venture). This academic partnership with the University of New Brunswick and the University of British Columbia is focused on understanding the origin and controls of lithium pegmatite mineralization in the Cat Lake–Winnipeg River field. Fieldwork for the MSc. thesis has been completed, while the post-doctoral phase is ongoing at UNB. This collaboration provides access to top-tier scientific expertise and equipment, significantly reducing analysis costs and adding long-term value to the project.

NAM’s Antimony-Gold division is in Newfoundland and spans over 19,800 hectares consisting of 11 non-contiguous properties. Six of these properties are in St. Alban’s area, along Canstar’s Swanger and Little River mineralized trends. The remaining 5 properties are strategically located along the same geological trend as the past-producing Beaver Brook Antimony Mine and in proximity to New Found Gold’s Queensway South Gold Project. Management has recently completed Phase 1 of the Project, Phase 2 has been initiated, and further news will follow. On July 30 th , the Company was pleased to announce that it has received formal approval under Newfoundland and Labrador’s Junior Exploration Assistance (JEA) Program , including eligibility for the Critical Minerals Assistance (CMA) and Provincial Critical Mineral Assistance (PCMA) streams. The potential rebate total for eligible exploration activities is $71,975.

The Company is actively seeking an option/joint venture partner for our and its road-accessible Genesis PGE-Cu-Ni Project in Alaska and results from our Summer/Fall Program are expected by the end of the year.

On August 6, 2025, New Age Metals announced an additional investment in a 4th critical metal. NAM currently owns approximately 12.79% and holds warrants that, if exercised with today’s issued and outstanding shares of MQM, would bring NAM to a 19.05% interest in MetalQuest Mining inc.

MetalQuest Mining inc. is developing one of North Americas largest iron projects, where approximately $120 million has been spent on the project. For more information, please visit MetalQuestMining.com . High-purity iron became a critical metal Federally in Canada and in the Provinces of Quebec and Newfoundland and Labrador in 2024. In the summer of 2025, MQM has contracted AtkinsRealis, an international engineering company, to complete a GAP Analysis on the Lac Otelnuk Project and its 2015 Feasibility Study. Results are expected by mid-October 2025.

Management is currently aggressively seeking new mineral acquisition opportunities on an international scale . Our philosophy is to be a project generator with the objective of optioning our projects with major and junior mining companies through to production

Investors are invited to visit the New Age Metals website at www.newagemetals.com where they can review the company and its corporate activities. Any questions or comments can be directed to info@newagemetals.com or Harry Barr at Hbarr@newagemetals.com or Farid Mammadov at faridm@newagemetals.com or call 613 659 2773.

Opt-in List

If you have not done so already, we encourage you to sign up on our website (www.newagemetals.com) to receive our updated news.

On behalf of the Board of Directors

“ Harry Barr ”

Harry G. Barr

Chairman and CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward Looking Statements: This release contains forward-looking statements that involve risks and uncertainties. These statements may differ materially from actual future events or results and are based on current expectations or beliefs. For this purpose, statements of historical fact may be deemed to be forward-looking statements. In addition, forward-looking statements include statements in which the Company uses words such as “continue”, “efforts”, “expect”, “believe”, “anticipate”, “confident”, “intend”, “strategy”, “plan”, “will”, “estimate”, “project”, “goal”, “target”, “prospects”, “optimistic” or similar expressions. These statements by their nature involve risks and uncertainties, and actual results may differ materially depending on a variety of important factors, including, among others, the Company’s ability and continuation of efforts to timely and completely make available adequate current public information, additional or different regulatory and legal requirements and restrictions that may be imposed, and other factors as may be discussed in the documents filed by the Company on SEDAR (www.sedar.com), including the most recent reports that identify important risk factors that could cause actual results to differ from those contained in the forward-looking statements. The Company does not undertake any obligation to review or confirm analysts’ expectations or estimates or to release publicly any revisions to any forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Investors should not place undue reliance on forward-looking statements.

Copyright (c) 2025 TheNewswire - All rights reserved.