MONTREAL, April 29, 2025 (GLOBE NEWSWIRE) -- Troilus Gold Corp. (“Troilus” or the “Company”) ( TSX: TLG; OTCQX: CHXMF; FSE: CM5R ) is pleased to announce positive drill results from its 2025 drill campaign (outlined in the February 4, 2025 press release ). The program is focused on identifying and delineating higher-grade mineralization and enhancing confidence in the block model.

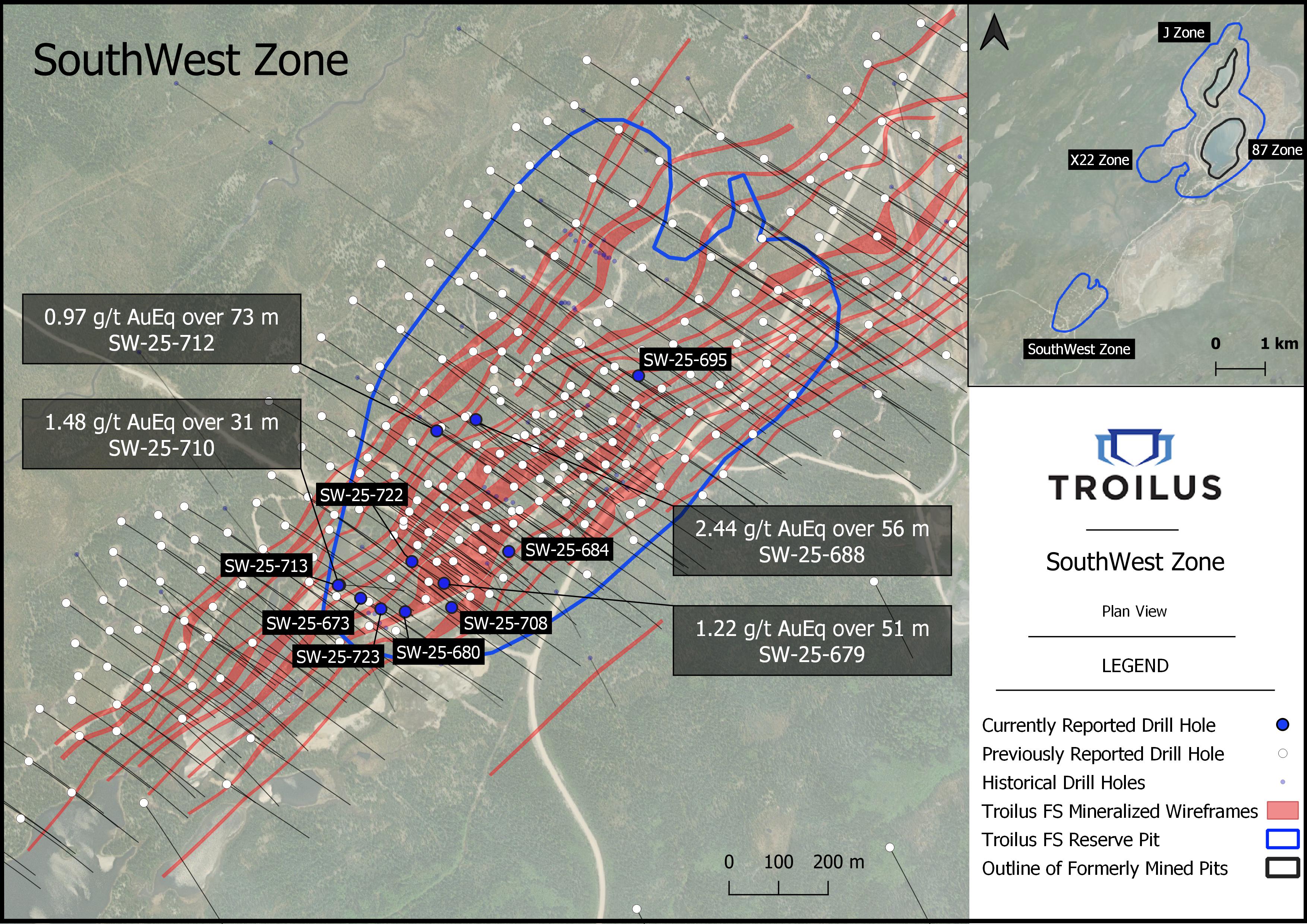

The results reported today include the best intercept drilled to date in the Southwest Zone (“Southwest”) based on linear grade ( grade x width ). These results confirm the continuity of higher-grade material within the Phase 1 reserve pit, which covers Years 1 to 5 of the mine plan. All intercepts reported lie within the current mine plan and drill hole locations relative to the Southwest reserve pit are shown in Figure 1. All grades are uncut and true thicknesses are approximately 75% to 90% of drilled length.

Southwest Drill Intercept Highlights:

-

Hole SW-25-688 intersected 2.44 g/t gold equivalent (“AuEq”)

(2.03 g/t Au, 2.55 g/t Ag, 0.23 % Cu)

over 56 m,

including 3.28 g/t AuEq

(2.74 g/t Au, 3.38 g/t Ag, 0.29 % Cu)

over 34 m

starting at 174 metres This is the best drill intercept in the history of the Southwest in terms of linear grade.

-

Hole SW-25-679 intersected 1.22 g/t AuEq

(1.13 g/t Au, 0.81 g/t Ag, 0.04 % Cu)

over 51 m

including 6.82 g/t AuEq

(6.71 g/t Au, 2.90 g/t Ag, 0.05 % Cu)

over 1 m, 1.75 g/t AuEq

(1.71 g/t Au, 0.46 g/t Ag, 0.02 % Cu)

over 9 m, 15.39 g/t AuEq

(15.25 g/t Au, 0.60 g/t Ag, 0.08 % Cu)

over 1 m, and 8.18 g/t AuEq

(7.33 g/t Au, 8.50 g/t Ag, 0.44 % Cu)

over 1 m

starting at 9 metres downhole.

-

Hole SW-25-712

intersected

0.97 g/t AuEq

(0.68 g/t Au, 0.80 g/t Ag, 0.14 % Cu)

over 73 m, including 1.84 g/t AuEq

(1.34 g/t Au, 0.76 g/t Ag, 0.29 % Cu)

over 19 m

starting at 189 metres downhole.

Justin Reid, CEO of Troilus Gold, commented, “We are very encouraged by the latest results from the Southwest Zone, which will be the first area mined when production begins. Hole SW-25-688 returned the highest linear-grade intercept drilled to date in this zone, highlighting the continuity of wide, high-grade mineralization in the core of the deposit. Additionally, SW-25-679 encountered strong near-surface grades that could further strengthen the early years of the mine plan. As the campaign progresses, we look forward to sharing more results that continue to improve confidence of the block model, de-risk the early production years, and enhance the overall development plan for the Troilus Project.”

*The completed NI 43-101 technical report associated with the Troilus Project FS can be found on SEDAR+ at www.sedarplus.ca under the Company’s issuer profile or on the Company’s website at

www.troilusgold.com

.

Southwest Drilling

The ongoing drill program at the Southwest Zone is focused on better defining high-grade zones in the early years of production. These first reported results include Troilus’s single best intercept in the history of drilling at the Southwest, in terms of linear grade. Drill hole SW-25-688 returned 2.44 g/t AuEq over 56 metres from the primary ore shoot on which the Phase 1 pit is centered and surpasses the previous strongest result from the Southwest of 1.56 g/t AuEq over 73 metres in hole TLG-ZSW20-189 ( see April 21, 2020 press release ).

Hole SW-25-679 returned several higher-grade intervals of 6.82 g/t AuEq over 1 metre, 1.75 g/t AuEq over 9 metres, 15.39 g/t AuEq over 1 metre and 8.18 g/t AuEq over 1 metre within a broader intersection of 1.22 g/t AuEq over 51 metres starting at just 9 metres downhole. These grades are notably higher than previously reported results from this area of the Southwest Zone, highlighting the potential for the ongoing drill program to not only de-risk the early years of mining, but also identify additional near-surface high-grade zones that could enhance early production.

Drilling in the Southwest is scheduled to continue until mid-May. In addition to drilling in the current pit shell, the program will include initial testing of several geophysical anomalies located outside the existing resource. These electro-magnetic anomalies are interpreted to be the result of volcanogenic mineralization, which, when encountered, has shown the potential to host significantly higher grades than those seen in the primary ore zones at Troilus. Follow-up drilling on these targets is planned for Fall 2025.

Figure 1. Plan map with the reported drill hole locations relative to the Southwest reserve pit

Table 1. Southwest Drill Results

| Hole | From (m) | To (m) | Interval (m) | Au Grade (g/t) | Cu Grade (%) | Ag Grade (g/t) | AuEq Grade (g/t) |

| SW-25-673 | |||||||

| 73 | 105 | 32 | 0.43 | 0.02 | 0.32 | 0.48 | |

| incl | 99 | 100 | 1 | 3.43 | 0.02 | 1.30 | 3.48 |

| 147 | 148 | 1 | 2.39 | 0.00 | 1.00 | 2.40 | |

| 167 | 183 | 16 | 0.66 | 0.04 | 0.35 | 0.73 | |

| incl | 181 | 182 | 1 | 6.75 | 0.14 | 2.20 | 7.01 |

| 191 | 192 | 1 | 0.97 | 0.06 | 1.60 | 1.09 | |

| SW-25-679 | |||||||

| 9 | 60 | 51 | 1.13 | 0.04 | 0.81 | 1.22 | |

| incl | 17 | 18 | 1 | 6.71 | 0.05 | 2.90 | 6.82 |

| incl | 27 | 36 | 9 | 1.71 | 0.02 | 0.46 | 1.75 |

| incl | 47 | 48 | 1 | 15.25 | 0.08 | 0.60 | 15.39 |

| incl | 58 | 59 | 1 | 7.33 | 0.44 | 8.50 | 8.18 |

| 78 | 80 | 2 | 1.31 | 0.17 | 2.00 | 1.62 | |

| 87 | 92 | 5 | 0.25 | 0.09 | 2.56 | 0.44 | |

| 100 | 111 | 11 | 0.18 | 0.08 | 0.71 | 0.32 | |

| 119 | 125 | 6 | 0.29 | 0.06 | 0.53 | 0.41 | |

| SW-25-680 | |||||||

| 24 | 27 | 3 | 1.21 | 0.00 | 0.00 | 1.22 | |

| 49 | 79 | 30 | 0.59 | 0.05 | 0.41 | 0.68 | |

| incl | 52 | 53 | 1 | 11.80 | 0.14 | 2.70 | 12.08 |

| 99 | 100 | 1 | 2.17 | 0.02 | 0.50 | 2.21 | |

| SW-25-684 | |||||||

| 66 | 68 | 2 | 0.43 | 0.13 | 1.85 | 0.67 | |

| 79 | 87 | 8 | 0.20 | 0.09 | 1.08 | 0.36 | |

| 95 | 99 | 4 | 1.43 | 0.03 | 0.75 | 1.50 | |

| incl | 95 | 96 | 1 | 5.05 | 0.10 | 3.00 | 5.25 |

| 110 | 111 | 1 | 1.13 | 0.07 | 1.50 | 1.27 | |

| SW-25-688 | |||||||

| 12 | 13 | 1 | 2.42 | 0.02 | 3.10 | 2.49 | |

| 131 | 132 | 1 | 0.78 | 0.21 | 2.80 | 1.17 | |

| 174 | 230 | 56 | 2.03 | 0.23 | 2.55 | 2.44 | |

| incl | 189 | 223 | 34 | 2.74 | 0.29 | 3.38 | 3.28 |

| and | 189 | 195 | 6 | 3.02 | 0.60 | 5.32 | 4.10 |

| and | 211 | 221 | 10 | 4.58 | 0.26 | 5.08 | 5.07 |

| 264 | 282 | 18 | 0.34 | 0.02 | 0.72 | 0.39 | |

| incl | 278 | 279 | 1 | 1.59 | 0.19 | 3.70 | 1.95 |

| SW-25-695 | |||||||

| 10 | 12 | 2 | 1.87 | 0.12 | 0.75 | 2.08 | |

| incl | 10 | 11 | 1 | 3.37 | 0.19 | 1.50 | 3.70 |

| 28 | 34 | 6 | 0.30 | 0.01 | 0.00 | 0.32 | |

| 41 | 51 | 10 | 0.35 | 0.01 | 0.08 | 0.37 | |

| 74 | 80 | 6 | 0.91 | 0.05 | 2.10 | 1.05 | |

| incl | 79 | 80 | 1 | 4.74 | 0.11 | 6.00 | 5.00 |

| SW-25-708 | |||||||

| 18 | 24 | 6 | 0.32 | 0.07 | 0.52 | 0.44 | |

| 30 | 43 | 13 | 0.22 | 0.05 | 0.42 | 0.32 | |

| 49 | 59 | 10 | 0.37 | 0.03 | 0.10 | 0.43 | |

| SW-25-710 | |||||||

| 16 | 23 | 7 | 0.21 | 0.05 | 0.77 | 0.30 | |

| 31 | 37 | 6 | 0.28 | 0.01 | 0.00 | 0.30 | |

| 47 | 48 | 1 | 1.53 | 0.01 | 0.00 | 1.55 | |

| 77 | 78 | 1 | 2.37 | 0.04 | 0.00 | 2.44 | |

| 93 | 106 | 13 | 0.73 | 0.02 | 0.15 | 0.77 | |

| incl | 105 | 106 | 1 | 7.21 | 0.05 | 0.60 | 7.29 |

| 114 | 115 | 1 | 2.09 | 0.00 | 0.00 | 2.10 | |

| 124 | 155 | 31 | 1.39 | 0.05 | 0.29 | 1.48 | |

| incl | 128 | 129 | 1 | 10.30 | 0.02 | 0.80 | 10.34 |

| incl | 142 | 147 | 5 | 5.70 | 0.01 | 0.00 | 5.73 |

| and | 143 | 144 | 1 | 18.90 | 0.00 | 0.00 | 18.91 |

| 174 | 221 | 47 | 0.35 | 0.03 | 0.33 | 0.41 | |

| SW-25-712 | |||||||

| 100.7 | 106 | 5.3 | 0.24 | 0.09 | 0.37 | 0.39 | |

| 113 | 115 | 2 | 0.34 | 0.10 | 0.00 | 0.50 | |

| 163 | 164 | 1 | 1.09 | 0.01 | 0.50 | 1.11 | |

| 177 | 178 | 1 | 1.22 | 0.01 | 1.10 | 1.26 | |

| 189 | 262 | 73 | 0.68 | 0.14 | 0.80 | 0.97 | |

| incl | 202 | 221 | 19 | 1.34 | 0.29 | 0.76 | 1.84 |

| and | 219 | 220 | 1 | 6.48 | 1.08 | 4.80 | 8.35 |

| incl | 248.65 | 250 | 1.35 | 4.85 | 0.10 | 1.00 | 5.04 |

| SW-25-713 | |||||||

| 86 | 97 | 11 | 0.93 | 0.02 | 0.15 | 0.97 | |

| incl | 88 | 90 | 2 | 4.26 | 0.01 | 0.00 | 4.28 |

| 119 | 145 | 26 | 0.34 | 0.04 | 0.42 | 0.41 | |

| SW-25-722 | |||||||

| 3 | 11 | 8 | 0.69 | 0.03 | 0.39 | 0.75 | |

| 26 | 27 | 1 | 1.75 | 0.00 | 0.00 | 1.76 | |

| 50 | 56 | 6 | 0.78 | 0.00 | 0.00 | 0.79 | |

| incl | 53 | 54 | 1 | 3.37 | 0.00 | 0.00 | 3.38 |

| 62 | 109 | 47 | 0.74 | 0.03 | 0.51 | 0.80 | |

| incl | 85 | 86 | 1 | 9.16 | 0.17 | 2.50 | 9.48 |

| incl | 95 | 96 | 1 | 5.85 | 0.01 | 0.50 | 5.87 |

| incl | 101 | 102 | 1 | 3.31 | 0.11 | 3.60 | 3.54 |

| 159 | 163 | 4 | 0.17 | 0.08 | 0.90 | 0.32 | |

| 167 | 180 | 13 | 0.35 | 0.08 | 0.85 | 0.49 | |

| SW-25-723 | |||||||

| 16 | 23 | 7 | 0.44 | 0.01 | 0.24 | 0.46 | |

| 50 | 71 | 21 | 0.43 | 0.03 | 0.61 | 0.50 | |

| 108 | 117 | 9 | 0.30 | 0.04 | 0.31 | 0.37 | |

| 142 | 143 | 1 | 12.55 | 0.53 | 28.40 | 13.79 | |

* AuEq = Au + 1.6823 x Cu + 0.0124 x Ag

Quality Assurance and Control

During the drill program, one meter assay samples were taken from NQ core and sawed in half. One-half was sent for assaying at ALS Laboratory, a certified commercial laboratory, and the other half was retained for results, cross checks, and future reference. A strict QA/QC program was applied to all samples; which included insertion of one certified mineralized standard and one blank sample in each batch of 25 samples. Every sample was processed with standard crushing to 85% passing 75 microns on 500 g splits. Samples were assayed by one-AT (30 g) fire assay with an AA finish and if results were higher than 3.5 g/t Au, assays were redone with a gravimetric finish. For QA/QC samples, a 50 g fire assay was done. In addition to gold, ALS laboratory carried out multi-element analysis for ME-ICP61 analysis of 33 elements four acid ICP-AES.

Qualified Person

The technical and scientific information in this press release has been reviewed and approved by Nicolas Guest, P.Geo., Exploration Manager, who is a Qualified Person as defined by NI 43-101. Mr. Guest is an employee of Troilus and is not independent of the Company under NI 43-101.

AuEq Disclosure

The formulas used to calculate equivalent values for resources are as follows, for 87 Pit AuEq = Au + 1.5628*Cu +0.0128 *Ag, for J Pit AuEq = Au + 1.5107*Cu +0.0119 *Ag, for SW Pit AuEq = Au + 1.6823*Cu +0.0124 *Ag, for X22 Pit AuEq = Au + 1.5628*Cu +0.0128 *Ag. AuEq was calculated using metal prices of $1,850/oz Au; $4.25/lb Cu and $23.00/oz Ag.

About Troilus Gold Corp.

Troilus Gold Corp. is a Canadian development-stage mining company focused on the systematic advancement of the former gold and copper Troilus Mine towards production. Troilus is located in the tier-one mining jurisdiction of Quebec, Canada, where it holds a large land position of 435 km² in the Frôtet-Evans Greenstone Belt. A Feasibility Study completed in May 2024 supports a large-scale 22-year, 50ktpd open-pit mining operation, positioning it as a cornerstone project in North America.

For more information:

Caroline Arsenault

VP Corporate Communications

+1 (647) 407-7123

info@troilusgold.com

Cautionary Note Regarding Forward-Looking Statements and Information

This press release contains “forward-looking statements” within the meaning of applicable Canadian securities legislation. Forward-looking statements include, but are not limited to, statements regarding the impact of the drill results on the Company, the results of the FS and the timing of the supporting technical report to be filed, including, without limitation various project economics, financial and operational parameters such as the timing and amount of future production from the Project, expectations with respect to the IRR, NPV, payback and costs of the Project, anticipated mining and processing methods of the Project; proposed infrastructures, anticipated mine life of the Project, expected recoveries and grades, timing of future studies including the environmental assessments (including the timing of an environmental impact study) and development plans, opportunity to expand the scale of the project, the project becoming a cornerstone mining project in Noth America; the development potential and timetable of the project; the estimation of mineral resources and reserves; realization of mineral resource and reserve estimates; the timing and amount of estimated future exploration; costs of future activities; capital and operating expenditures; success of exploration activities; the anticipated ability of investors to continue benefiting from the Company’s low discovery costs, technical expertise and support from local communities, the timing and amount of estimated future exploration; and the anticipated results of the Company’s 2024 drill program and their possible impact on the potential size of the mineral resource estimate. Generally, forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “continue”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “will”, “might” or “will be taken”, “occur” or “be achieved”. Forward-looking statements are made based upon certain assumptions and other important facts that, if untrue, could cause the actual results, performances or achievements of Troilus to be materially different from future results, performances or achievements expressed or implied by such statements. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which Troilus will operate in the future. Certain important factors that could cause actual results, performances or achievements to differ materially from those in the forward-looking statements include, amongst others, currency fluctuations, the global economic climate, dilution, share price volatility and competition. Forward-looking statements are subject to known and unknown risks, uncertainties and other important factors that may cause the actual results, level of activity, performance or achievements of Troilus to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: there being no assurance that the exploration program or programs of the Company will result in expanded mineral resources; risks and uncertainties inherent to mineral resource and reserve estimates; the high degree of uncertainties inherent to feasibility studies and other mining and economic studies which are based to a significant extent on various assumptions; variations in gold prices and other metals, exchange rate fluctuations; variations in cost of supplies and labour; receipt of necessary approvals; availability of financing for project development; uncertainties and risks with respect to developing mining projects; general business, economic, competitive, political and social uncertainties; future gold and other metal prices; accidents, labour disputes and shortages; environmental and other risks of the mining industry, including without limitation, risks and uncertainties discussed in the Company’s latest Annual Information Form, its technical reports and other continuous disclosure documents of the Company available under the Company’s profile at www.sedarplus.ca. Although Troilus has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Troilus does not undertake to update any forward-looking statements, except in accordance with applicable securities laws.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/ad9df989-0003-4d35-a351-a2e15a5215c5