VANCOUVER, BC / ACCESSWIRE / September 8, 2022 / Skeena Resources Limited (TSX:SKE)(NYSE:SKE) ("Skeena" or the "Company") is pleased to announce the results of the Feasibility Study ("FS") for the Eskay Creek gold-silver project ("Eskay Creek" or the "Project") located in the Golden Triangle of British Columbia.

Eskay Creek 2022 FS Highlights:

- After-tax net present value ("NPV") (5%) of C$1.41 billion at a base case of US$1,700 gold and US$19 silver

- Robust economics with an after-tax internal rate of return ("IRR") of 50.2% and an industry leading after-tax payback on pre-production capital expenditures of 1 year

- High-grade open-pit averaging 3.87 g/t gold equivalent ("AuEq") (2.99 g/t gold, 79 g/t silver) (diluted) with a strip ratio of 7.5:1

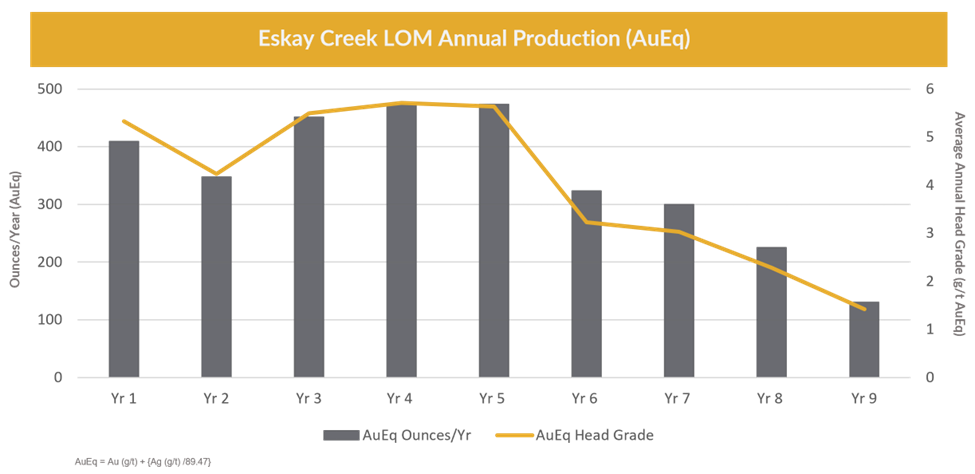

- Years 1 - 5 average annual production of 431,000 AuEq ounces, places Eskay Creek as a tier one operation

- Life of mine ("LOM") production of 3.2 million AuEq ounces from 2.4 million ounces of gold and 66.7 million ounces of silver

- Estimated pre-production capital expenditures ("CAPEX") of C$592 million, yielding a compelling after-tax NPV:CAPEX ratio of 2.4:1

- LOM all-in sustaining cost ("AISC") of US$652/oz AuEq recovered in concentrate

- Proven and Probable open-pit mineral Reserves of 29.9 million tonnes containing 2.87 million ounces gold and 75.5 million ounces silver (combined 3.85 million AuEq oz)

- A carbon intensity of 0.20 t CO2e/oz AuEq produced, positioning Eskay Creek to be one of the lowest carbon intensity mines worldwide

The Company will be hosting a conference call to present the FS results for Eskay Creek on Thursday September 8th at 8:00 AM PT / 11:00 AM ET. A presentation by management will be followed by Q&A.

Conference Call Webcast and Dial in Details:

Webcast URL with audio - https://services.choruscall.ca/links/skeenaresources202209feas.html

Participant Telephone Numbers - Canada/US 1-800-319-4610, International Toll +1-604-638-5340

Feasibility Study Presentation - https://skeenaresources.com/investors/feasibility-study-presentation/

If you'd like to ask a question, please dial in. All callers should dial in 5-10 minutes prior to the scheduled start time and simply ask to join the call.

Skeena's President, Randy Reichert commented, "The Feasibility Study confirms the robust economics of the world-class Eskay Creek Project originally shown in the Prefeasibility Study but with improved definition. The open-pit mineable, high-grade ore combined with the existing infrastructure at the Eskay Creek site and nearby hydropower provides for an extraordinary project that can be developed by Skeena. While the team continues to work on optimization of the Project, my primary focus will now shift to advancement of the permitting process as we move Eskay Creek toward construction."

Table 1: After-Tax NPV(5%) and IRR Sensitivities to Commodity Prices

Even Lower Case | Lower Case | Base Case | Higher Case | Upside Case | |

| Gold Price (US$/oz) | $1500 | $1600 | $1700 | $1800 | $1900 |

| Silver Price (US$/oz) | $15 | $17 | $19 | $21 | $23 |

| After-Tax NPV (5%) (C$M) | $1,044 | $1,228 | $1,412 | $1,596 | $1,780 |

| After-Tax IRR(%) | 41.0% | 45.7% | 50.2% | 54.6% | 58.7% |

| After-Tax Payback (years) | 1.29 | 1.14 | 1.01 | 0.93 | 0.83 |

| After-Tax NPV/Initial Capex | 1.8 | 2.1 | 2.4 | 2.7 | 3.0 |

| Average Annual After-TaxFree Cash Flow (Years 1 - 9) (C$M) | $237 | $265 | $293 | $321 | $350 |

Walter Coles, the Company's CEO added, "Eskay Creek is a truly unique deposit that provides excellent profit margins due to its existing infrastructure and very high open-pit grade. Even at US$1,400 gold and US$13 silver prices, the project still generates an average annual after-tax cash flow of C$209 million with an after-tax IRR of 36% and a 1.5 year payback on initial capital."

Eskay Creek Feasibility Study

The FS for Eskay Creek was completed by Ausenco Engineering Canada Inc. ("Ausenco"), supported by SRK Consulting (Canada) ("SRK"), and AGP Mining Consultants ("AGP"). The study confirms robust economics for a conventional open-pit mining and milling operation, with low initial capital cost intensity and a high rate of return. The FS presents a mine plan based on the same strategy first presented in the July 2021 Prefeasibility Study ("PFS"), with an updated Mineral Resource and Reserve estimate, refined mine and mill designs supported by additional geotechnical and metallurgical data, and updated capital and operating cost estimates. The Mineral Resource and Reserve updates do not include any new drilling completed since September 2021.

Summary of Key Results and Assumptions in the FS

Table 2: 2022 Eskay Creek FS Project Parameters

Base Case Economic Assumptions |

|

Gold Price (US$/oz) | $1,700 |

Silver Price (US$/oz) | $19 |

Exchange Rate (C$/US$) | 0.76 |

Discount Rate | 5% |

Contained Metals |

|

Contained Gold (koz) | 2,874 |

Contained Silver ounces (koz) | 75,538 |

Mining |

|

Mine Life (years) | 9 |

Strip Ratio (Waste: Mineralization) | 7.5:1 |

Total Material Mined (excluding rehandle) (Mt) | 255 |

Total Mineralized Material Mined (Mt) | 29.9 |

Processing |

|

Processing Throughput (Mtpa) | 3.0 (Yr 1 - 5) |

| 3.7 (Yr 6 - 9) |

Average Diluted Gold Grade (g/t) | 2.99 |

Average Diluted Silver Grade (g/t) | 78.55 |

Production |

|

Gold Recovery (%) | 84.2 |

Silver Recovery (%) | 88.3 |

LOM Gold Production (koz) | 2,419 |

LOM Silver Production (koz) | 66,707 |

LOM AuEq Production (koz) | 3,164 |

LOM Avg. Annual Gold Production (koz) | 269 |

LOM Avg. Annual Silver Production (koz) | 7,412 |

LOM Avg. Annual AuEq Production (koz) | 352 |

Operating Costs Per Tonne |

|

Mining Cost (C$/t Mined) | $3.72 |

Mining Cost (C$/t Milled) | $30.12 |

Processing Cost (C$/t Milled) | $16.91 |

G&A Cost (C$/t Milled) | $4.20 |

Total Operating Costs (C$/t Milled) | $51.24 |

Other Costs |

|

Transport to Smelter (C$/wmt) | $140 |

Royalty (NSR %) | 2.0% |

Cash Costs and All-in Sustaining Costs |

|

LOM Cash Cost (US$/oz Au) net of silver by product | $253 |

LOM Cash Cost (US$/oz AuEq) co-product | $572 |

LOM AISC (US$/oz Au) net of silver by-product | $355 |

LOM AISC (US$/oz AuEq) co-product | $652 |

Capital Expenditures |

|

Pre-production Capital Expenditures (C$M) | $592 |

Expansion Capital Expenditures (C$M) | $40 |

Sustaining Capital Expenditures (C$M) | $140 |

Closure Expenditures (C$M) | $138 |

Economics |

|

After-Tax NPV (5%) (C$M) | $1,412 |

After-Tax IRR | 50.2% |

After-Tax Payback Period (years) | 1.0 |

After-Tax NPV / Initial Capex | 2.4 |

Pre-Tax NPV (5%) (C$M) | $2,094 |

Pre-Tax IRR | 59.5% |

Pre-Tax Payback Period (years) | 0.99 |

Pre-Tax NPV / Initial Capex | 3.5 |

Average Annual After-tax Free Cash Flow (Year 1-9) (C$M) | $293 |

LOM After-tax Free Cash Flow (C$M) | $2,110 |

- Cash costs are inclusive of mining costs, processing costs, site G&A and royalties

- AISC includes cash costs plus corporate G&A, sustaining capital and closure cost

- All dollar ($) figures are presented in CAD unless otherwise stated. Base case metal prices used in this economic analysis are US$1,700/oz Au and US$19.00/oz Ag. These prices are based on long-term average prices.

Refer to Appendix A below for a comparison of key statistics between the Company's July 2021 PFS and this FS.

Eskay Creek Mineral Resource Estimate

The Company's current Mineral Resource Estimate ("MRE"), completed by SRK, has an effective date of January 18, 2022 and forms the basis for the FS. The MRE does not include drilling results received since September 2021. Mineral Resources are reported inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability at this time.

Table 3: Pit constrained Mineral Resource Statement reported at 0.7 g/t AuEq cut-off

Grade | Contained Ounces | ||||||

Resource Class | Tonnes (Mt) | AuEq (g/t) | Au (g/t) | Ag (g/t) | AuEq (Moz) | Au (Moz) | Ag (Moz) |

| Measured | 21.8 | 4.8 | 3.5 | 92.4 | 3.4 | 2.5 | 64.7 |

| Indicated | 24.7 | 2.3 | 1.8 | 37.6 | 1.8 | 1.4 | 29.9 |

| Total M&I | 46.5 | 3.5 | 2.6 | 63.2 | 5.2 | 3.9 | 94.6 |

- Results are reported in-situ and undiluted and are considered to have reasonable prospects for economic extraction

- As defined by NI 43-101, the Independent and Qualified Person is Ms. S. Ulansky, P.Geo. of SRK Consulting (Canada) who has reviewed and validated the Mineral Resource Estimate

- The effective date of the Mineral Resource Estimate is January 18, 2022

- The number of metric tonnes and ounces were rounded to the nearest thousand. Any discrepancies in the totals are due to rounding

- Pit constrained Mineral Resources are reported in relation to a conceptual pit shell

- Block tonnage was estimated from average specific gravity measurements using lithology and zone groupings

- All composites have been capped where appropriate

- Pit mineral resources are reported at a cut off grade of 0.7 g/t AuEq, cut off grades must be evaluated considering prevailing market conditions

- Estimates use metric units (metres, tonnes and g/t). Metals are reported in troy ounces (metric tonne * grade /31.10348)

- CIM definitions were followed for the classification of mineral resources

- Neither the Company nor SRK is aware of any known environmental, permitting, legal, title-related, taxation, socio-political, marketing or other relevant issue that could materially affect this mineral resource estimate

- Cut-off grades are based on a price of US$1,700/oz Au, US$23/oz Ag, and gold recoveries of 90%, silver recoveries of 80% and without considering revenues from other metals.

- AuEq = Au (g/t) + [Ag (g/t) / 74]

Mining Overview

The Eskay Creek Project is planned to be an open-pit operation using conventional mining equipment. The potential for an underground mining component to the Project is still being evaluated. Pit designs were developed for the north and south pit areas. The initial phases were designed for the purpose of obtaining a technical sample and necessary non-acid generating waste material ("NAG") to create supporting infrastructure. Open-pit mining follows down slope of the ridge where the deposit is located and there are no major pushbacks required. The north pit will consist of three main phases, while the south pit will only contain a single small phase.

Table 4: 2022 Eskay Creek Proven and Probable Reserves

Grade | Contained Ounces | ||||||

Reserve Class | Tonnes (Mt) | AuEq (g/t) | Au (g/t) | Ag (g/t) | AuEq (Moz) | Au (Moz) | Ag (Moz) |

| Proven | 17.3 | 4.92 | 3.64 | 99 | 2.73 | 2.02 | 55.1 |

| Probable | 12.6 | 2.75 | 2.10 | 50 | 1.12 | 0.85 | 20.5 |

| Total | 29.9 | 4.00 | 2.99 | 79 | 3.85 | 2.87 | 75.5 |

Note: This Mineral Reserve Estimate has an effective date of June 30, 2022 and is based on the Mineral Resource estimate dated January 18, 2022 for Skeena Resources by SRK (which has been updated since the PFS). The Mineral Reserve estimate was completed under the supervision of Willie Hamilton, P.Eng. of AGP, who is a Qualified Person as defined under NI 43-101. Mineral Reserves are stated within the final design pit based on a US$1,550/oz gold price and US$20.00/oz silver price. An NSR cut-off of C$24.45/t was used to define reserves based on preliminary processing costs of $18.22/t ore and G&A costs of C$6.23/t ore. The metallurgical recoveries varied according to gold head grade and concentrate grades. Gold and silver recoveries were approximately 83% overall during the LOM scheduling. Final operating costs within the pit design were C$3.72/t mined, with associated process costs of C$16.91/t ore and G&A costs of C$4.20/t ore.

The FS outlines an average production profile of 431,000 AuEq ounces in the first 5 years of operation. It is anticipated that Skeena will have a stockpile developed ahead of mill start-up of approximately 600,000 tonnes of ore.

Graph 1: Eskay Creek LOM Production Profile

Mine planning indicates that the northern end of the north pit will intersect Tom MacKay Creek, requiring the construction of a water diversion tunnel by Year 5 to route the creek flow around the open-pit before re-joining the existing creek downstream. Minimum tunnel dimensions have been selected as 4.7 metres wide by 4.7 metres high to accommodate the expected water flows. The full length of the tunnel is 1.2 kilometres.

The mine schedule plans to