The Cadia Discovery

The Cadia Discovery

When a company drills 102m @ 0.13 g/t Au and 0.40% Cu at a vertical depth of about 500 metres, people will quickly agree: "this will not work - this is low grade". Then why did Newcrest drill another set

When a company drills 102m @ 0.13 g/t Au and 0.40% Cu at a vertical depth of about 500 metres, people will quickly agree: "this will not work - this is low grade". Then why did Newcrest drill another set of holes which led to the Ridgeway (part of Cadia) discovery? The story:

The exploration tale begins in 1851 when copper and gold were found in Cadia. Over time, sporadic mining occurred, notably at Iron Duke, now Big Cadia. Modern exploration commenced in the mid-1960s with Pacific Copper Limited targeting Big Cadia and Little Cadia. Fast-forward to 1985, Homestake's drilling investigated magnetic anomalies, setting the stage for subsequent developments.

In 1986, BHP Gold Mines acquired Browns Creek Mine, invigorating interest. Geologists joined to explore gold prospects. Pacific Copper had previously delineated copper and gold resources. Financial challenges led to Cadia's ownership transfer to FAI and eventually to BHP Gold. The merger of BHP Gold and Newmont Australia led to the birth of Newcrest.

Exploration commenced on the grounds, valued at $400 million. In 1991, an ambitious goal was set: discover 2 million ounces of gold in three years.

Focus shifted to Cadia Hill, marked by a historical open pit and previous exploration. Though earlier findings didn't resonate, geological features sparked intrigue. Despite skepticism due to size and grade, Exploration Manager Dan Wood secured approval for an ambitious program. Gradually, Cadia Hill emerged as a significant copper and gold discovery.

By 1994, Cadia Hill's transition into a mineable resource was underway, facilitated by figures like Dan Wood and John Holliday. A $38 million investment transformed Newcrest from an explorer to a miner, with borrowing for a $440 million mine. Cadia Hill's appeal lay in its favorable strip ratio.

This journey underscored Dan Wood's insight that mineral exploration is a product of chaotic processes and non-linear thinking.

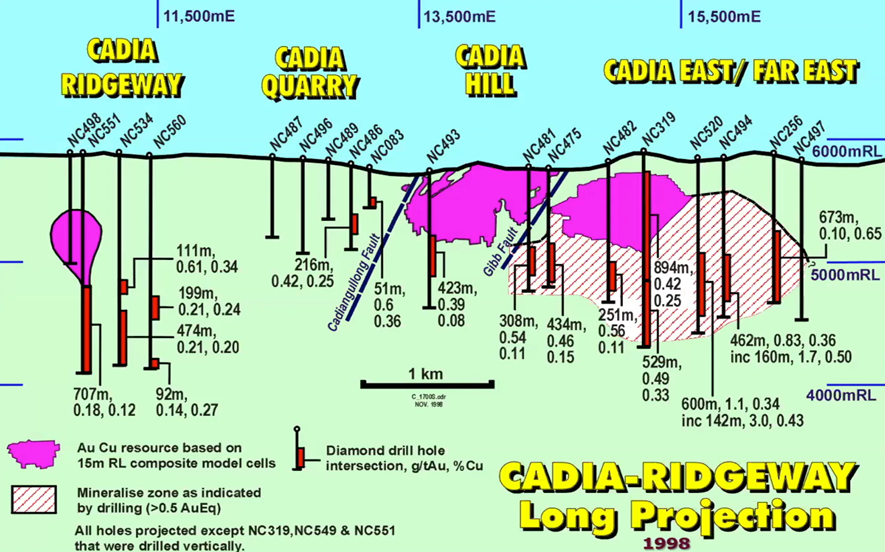

Further exploration revealed promising deposits along the Cadia trend. The first mineral resource estimate in 1995 was 1.9 million ounces, growing to 4.6 million ounces of gold and 1.1 million tons of copper. Despite initial grade concerns, richer deposits were soon discovered.

A comprehensive induced polarization survey uncovered Cadia Hill and Cadia East. The choice of a less promising IP option led to the discovery of Ridgeway through alteration halos with pyrite. Subsequent drilling revealed fault lines and notable copper and gold spikes, confirming Ridgeway's presence.

The journey led to Cadia Far East's discovery through wildcat drilling, highlighting the significance of geological exploration. This transformation ultimately elevated Newcrest to an $18 billion company, underscoring Cadia's pivotal role in its growth as a major gold and copper producer.