Richard Warke's mining story

Richard Warke's mining story

Born in Vancouver in 1960, Richard Warke's life story is a remarkable journey of a versatile entrepreneur who left an indelible mark in the resource

Born in Vancouver in 1960, Richard Warke's life story is a remarkable journey of a versatile entrepreneur who left an indelible mark in the resource sector and beyond. His extraordinary odyssey began in the early 1980s when he emerged as a young and ambitious businessman, displaying his potential even before his twenties.

During those formative years, Richard Warke established influential alliances in the mining world, none more significant than his partnership with Murray Pezim, a legendary figure in the junior mining domain. Under Pezim's guidance, Warke ascended to the presidency of several of Pezim's mining ventures, most notably Templar Mining, which was engaged in gold exploration near the Asamera/Breakwater discovery in Wenatchee, Washington. He also held the position of President at Wescal Resources, where the company acquired claims near the British Petroleum/Selco gold discovery.

A pivotal moment in Warke's early career was marked by the discovery of Eskay Creek, an extraordinary high-grade gold deposit situated in the heart of British Columbia. In 1989, the 109th drill hole intercepted an astonishing 208 meters at a gold grade of 27.4 g/t. Just days before this momentous find, Pezim granted Warke 125,000 options of Prime Resource Corp, a company that was part of the Pezim stable and a strategic investor in Calpine, the owner of Eskay Creek. This event would later become the focal point of a legal dispute between the British Columbia Superintendent of Brokers and Pezim, shedding light on issues related to disclosure and insider trading.

The Eskay Creek discovery triggered a protracted battle for control, involving several corporate entities, including Calpine, Prime, Stikine, Corona, Placer Dome, and Homestake. Ultimately, Homestake emerged victorious, taking control of Eskay Creek in 1992. Pezim received much of the credit for being the promoter behind yet another major discovery, but Warke has experienced something that most people never get to experience, being part of a major gold discovery. Before he made a significant name for himself in this field, Warke ventured into the wood industry.

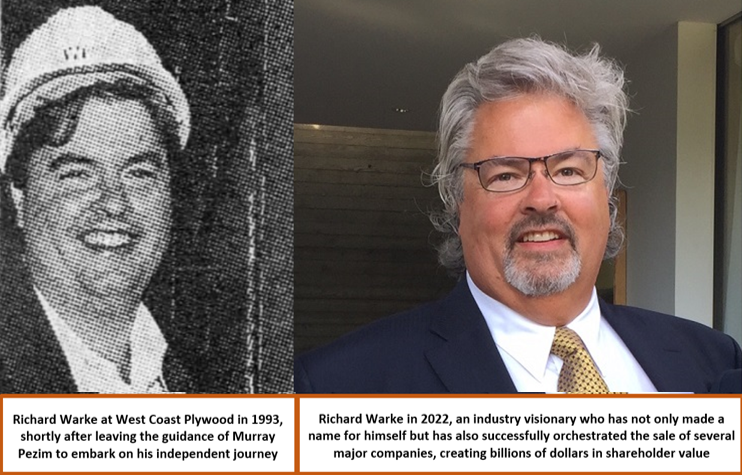

Warke took on the revival of West Coast Plywood Co. in Vancouver at the tender age of 32. Despite encountering various challenges along the way, Warke's persistence and vision ultimately revitalized the company. West Coast's production strategy focused on producing plywood from cottonwood and alder, hardwood species historically used until 1961. The company's unique ability to handle hardwoods and produce larger sheets set it apart from competitors, positioning it to target niche plywood markets. Warke's long-term vision extended beyond plywood to include the acquisition of other forest product producers, with the aim of establishing West Coast Forest Products as a major industry player.

In the mid-1990s, Warke returned to the mining industry during a period when junior miners saw their stocks surge dramatically. Richard Warke founded Golden Bear Minerals, which experienced a rapid rise in stock price from $0.40 to $2.90 in just five months after acquiring properties in Indonesia during the Bre-X frenzy. However, when the truth behind Bre-X's deceit came to light, Golden Bear's stock also plummeted from $2.90 to $0.35, prompting Warke to rebrand it as Augusta Gold Corp, marking the beginning of a quarter-century involvement with Augusta group companies.

Warke continued to implement the area play strategy he learned during his days with Pezim by acquiring a property adjacent to Western Copper's San Nicholas massive sulphide discovery in Zacatecas. Although this venture did not yield the expected results, it led to Augusta's consolidation of shares and a name change, transforming into Pulse Data. The company subsequently acquired a 50% stake in approximately 3,920 line-kilometers of seismic data used in the oil and gas industry.

Amidst his diverse ventures, Warke also initiated Augusta Metals (formerly First Western), which purchased the assets of CyberCom, a software company. The company experienced a brief rally during the internet boom but faltered when the boom ended.

In the early 2000s, another chapter unfolded in Warke's journey with the birth of Augusta Resource Corp. The company ventured into the hunt for diamonds in the North Slave diamond play of southern Nunavut, triggering a modest increase in its shares. Augusta negotiated to obtain a 70% stake in the BH property owned by 4763 NWT Ltd., setting the stage for further exploration and development. Dr. Chris Jennings, a diamond industry expert, joined the team in 2002. However, this venture also did not lead to a significant breakthrough.

In 2005, Augusta Resource Corp made a significant acquisition, purchasing the Rosemont ranch copper deposits in Pima County, Arizona, which contained potentially open-pit-minable copper/molybdenum skarn deposits. This marked a pivotal moment in the company's history and in Richard's career. Richard had earned substantial profits in the 1980s alongside Pezim and again during the mining boom of the 1990s. However, he had not yet independently led a resource deal to the finish line. The Rosemont acquisition was highly financeable, and Augusta began drilling.

The Rosemont project was recognized by the market as a potentially tier 1 project. Richard, who had already been described as a skilled negotiator in the Vancouver Sun in the 1980s, finally had a project where he could use his skills to get the maximum out of this successful acquisition. In 2007, Augusta Resources caught the attention of Sumitomo, a major Japanese company, which acquired a significant interest at a 40% premium to the market, without any warrants.

In 2012, Augusta Resource Corp completed an updated National Instrument 43-101-compliant mineral resource for its Rosemont copper project, estimating substantial copper reserves (919 Mt @ 0.41% Cu) and a net present value of US$3.65 billion.

In 2014, Hudbay Minerals acquired Augusta Resource for C$555 million, taking control of the Rosemont copper project in Arizona. The acquisition marked the end of an era for Augusta Resource Corp, but Richard Warke's entrepreneurial journey continued to evolve.

It was not just Augusta Resource Corp that occupied Richard in those years. Richard Warke also founded Ventana Gold Corp, a company focused on exploration in Colombia. Ventana made a significant gold discovery and was a multi-bagger with headlines like 94m @ 16 g/t gold. Renowned figures like Ross Beaty and Brazilian billionaire Eike Batista got involved as strategic shareholders. Batista even continued buying stock in the secondary market. Eventually, in 2010, Batista acquired Ventana for $1.5 billion.

Subsequent to the successful divestment of Ventana Gold Corporation and Augusta Resource Corporation, Richard Warke shifted his strategic focus to the growth and development of Arizona Mining Inc. This period was marked by intensive efforts in the exploration and advancement of the Hermosa-Taylor zinc-lead-silver project located in Santa Cruz County, Arizona. Under Warke's leadership, Arizona Mining achieved remarkable resource expansion, firmly establishing the project as one of the best CRD's in the world.

The culmination of these endeavors was the highly significant sale of Arizona Mining to South32 Ltd., a prominent company based in Perth, Australia, for a substantial sum of C$2.1 billion in the year 2018.

Today, the Augusta Group, under Richard Warke's visionary leadership, consists of private businesses and public corporations such as Titan Mining Corporation, Augusta Gold Corp, and Solaris Resources Inc, each making a significant impact on resource ventures across the Americas. In 2017, Warke co-founded Equinox Gold with Ross Beaty, which swiftly emerged as a major gold producer with a significant market capitalization.

Beyond his accomplishments in the resource sector, Richard Warke also assumed the role of a minority partner in Fenway Sports Group, owners of the Boston Red Sox and Liverpool F.C. His life's journey is a testament to the transformation from a young entrepreneur in Vancouver to a towering figure in the global resource industry and beyond. Richard Warke's legacy continues to inspire and shape the industries he touched, leaving an enduring mark on the business world.